Douyin, a hip short video app that is popular among China’s young social media users, has hit the radar of luxury marketers.

Despite some critics’ concerns that the app’s mass-facing content could diminish luxury brands’ prestigious image, that hasn’t stopped leading players like Christian Dior, Louis Vuitton, and Chanel from placing advertisements on the platform.

Christian Dior, one of the earliest adopters from the luxury sector, is highly bullish on using Douyin. “Douyin has the user base, who are young, female-oriented with high-spending power,” a spokesperson for the French luxury brand China division told Jing Daily. “They are the right people who luxury brands must acquire and retain in the longer term.”

The latest statistics released by Douyin CEO Zhang Nan (张楠) on January 15 indicated the app’s number of daily active users (DAU) reached 250 million and the monthly active users exceeded 500 million. Previous data also showed around 60 percent of Douyin users are female, and about 70 percent of them reside in China’s top-tier cities.

The user volume and demographic composition is certainly alluring to digital marketers. And, for an app that was only launched in September 2016, it signals great growth potential.

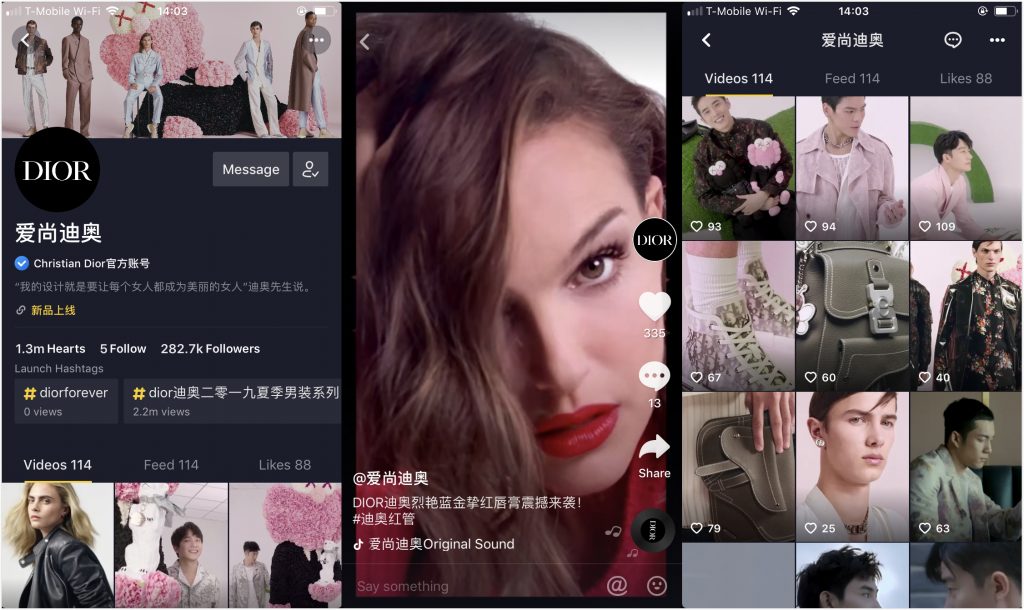

Beyond placing advertisements, Christian Dior has an official account on Douyin whose posting schedule is in sync with the brand’s movements in China. Photo: Jing Daily illustration

Beyond placing advertisements, Christian Dior has an official account on Douyin with a posting schedule in sync with the brand’s movements in China. Since its launch last August, the French luxury powerhouse has attracted approximately 282,700 followers and received over 1.3 million “hearts” on their posts, after posting 114 videos with 10 hashtags.

The performance of Christian Dior videos is quite uneven though. Its best-performing video (see below), featuring Chinese actresses including Angelababy, Wang Ziwen and Wang Luodan posing with Saddle Bags, was liked 183,500 times and commented on by 4,100 users. Videos introducing the brand’s “Lady Dior” bags in collaboration with artists last December also, on average, reached 100,000 likes. But it is also quite common to see the engagement level of many posts fall below 1,000 or even 100.

“The video format on Douyin is vertical, so the right content and format is the key in determining if a video can go viral on Douyin,” said Jason Yu, General Manager of Kantar Worldpanel China. “[A good video should] motivate followers to regenerate secondary content for secondary communication.”

Other luxury brands’ approach to Douyin has been much more cautious. A few weeks ago, French luxury giant Louis Vuitton tested the water. The brand launched a Christmas campaign that lasted for two days from December 18 to 19.

Some targeted users were able to view the ad in their feeds and click through to land on the sales page to place orders. Chinese media outlet Jiemian reported that the click-through rate of the Louis Vuitton ad was higher than the industry average.

Much earlier in July, Chanel’s advertisement on Douyin attracted criticism from industry professionals after the campaign failed to live up to the expectations of impressions and sales.

Chanel advertised its J12 watch collection on a Douyin’s official account named “meihaoyingwuzhi (美好映物志)” that showcases arty lifestyle content. The account directly posted Chanel’s campaign videos for J12 Watches.

To Ashley Galina Dudarenok, author of the Amazon bestseller “Digital China: Working with Bloggers, Influencers and KOLs,” it was a typical example illustrating how luxury brands over-cater to fashion and digital trends in China.

An Qianni, senior account executive of CuriosityChina — a Farfetch company — further explained: “What can really go viral on Douyin is always content that is down-to-earth and even sometimes ‘distasteful.’” In other words, there is a mismatch issue between Douyin’s audience and luxury clients.

Christian Dior seems to disagree. “The logic of Douyin’s content is algorithm-driven, that means, readers’ viewing habits shape the content they will be receiving on their feeds. Therefore, we believe [our marketing messages] are capable of reaching our targeted users who exist on the platform,” according to the company.

Another concern is whether their targeted audience has the purchasing power to buy luxury goods.

“As it turns out, most of the Douyin users cannot afford luxury goods,” said Dudarenok, whose point was echoed by Yu from Kantar WorldPanel, saying, “Given the premium and exclusive nature of luxury goods, the sales-conversation rate generating from marketing on Douyin will be relatively low. In other words, there will be more people viewing the content but [far fewer] people purchasing products.”

In recent months, Douyin has also started to expand its e-commerce functionality to further support brands and retailers to capitalize on their traffic. Christian Dior, for example, added a store on it, allowing app users to place orders there. In Chanel’s advertisement campaign, that account also added purchase links within videos to facilitate consumption.

“Douyin adding an e-commerce feature is in line with the general trend of convergence between e-commerce and digital content that spell sales opportunities for brands,” Kantar’s Yu noted.

On whether it represents a threat to the current social media marketing king WeChat, Yu said “WeChat has a complete ecosystem, from social, videos, to mini-program and payment. Douyin is far from a threat to it yet.”

– This article originally appeared on Jing Daily.